The world’s most celebrated olive oil comes from sun-drenched groves of Italy. But Italy is also a hotbed of olive oil subterfuge, counterfeit, and adulteration—and has been since Roman times, as Tom Muellar showed in an eye-opening 2007 New Yorker piece (which grew into a book called Extra Virginity: The Sublime and Scandalous World of Olive Oil.) Next year, getting real olive oil from Italy is going to be even harder than usual. Here’s the LA Times’ Russ Parsons:

As a result of what the Italian newspaper La Repubblica is calling “The Black Year of Italian Olive Oil,” the olive harvest through much of Italy has been devastated—down 35% from last year.

The reason is a kind of perfect storm (so to speak) of rotten weather through the nation:

Alain Ducasse on naturality and connectedness of every participant to the final product.

Today’s Worker Bee series follows Alain Ducasse, one of the two chefs in the world, holding 21 Michelin stars. In the video, he talks about his recently re-opened restaurant Plaza Athenee in Paris, which focuses on all things natural.

“Everything is connected,

The way we eat is important,

Not only for us but also for the planet

We have to change the way we consume

It means less fat, sugar, salt and animal proteins

Which is not only good for us but also for our planet.”

He introduces a cuisine of naturality, which revolves around three elements: fish, cereals and vegetables. A healthier, more sustainable and environmentally conscious meal.

Inadvertent Metadata Collection from a President George W. Bush Talk

I have to admit that I don’t listen to NPR’s news programs that often. I’ve found them to be far too intertwined with the DC political class. Yet, from time to time, I inadvertently collect their signal. So it was this morning.

I was somewhat surprised to hear an interview with former President George W. Bush. It reminded me of an event I attended earlier this year, where the former President spoke for just under two hours. More conversation than speech, the event was illuminating, particularly the comments on isolationism, immigration and economic growth.

Sponsored by a “too big to fail” bank, the event was off the record. Yet, in keeping with the times, I did collect some metadata. I have not searched the metadata, just collected it.

The NPR interview [here, here and here.] reminded me of the most interesting appearance data. Collected by a table mate, a “liberal democrat from New York” – “I’m no fan of Obama”, I found the metadata to be a fascinating look at the dynamics of President Bush the 2nd’s eight years in office.

## Metadata:

The administration official referenced most often by the former President was Condoleezza Rice. Ben Bernanke & Henry Paulson’s names were uttered not a few times while former Vice President Dick Cheney merited a single mention and Defense Secretary Donald Rumsfeld’s name failed to enter the conversation.

Metadata ##.

A few photos and a panorama from the George W. Bush Presidential Library.

American Telcos & The Apple SIM

I have long wanted to give T-Mobile a try. GSM, the CEO’s populist rhetoric and an attractive international roaming scheme (does it work?) attracted my attention.

That said, I’ve been reasonably happy with AT&T’s LTE service, particularly while on travel demonstrating apps to clients. Not to mention doing the same while seated in the passenger seat of a car at speed on an interstate.

I’ve been an AT&T wireless client for some time, since the arrival of the iPhone. Yet, I have become increasingly annoyed at their efforts to gouge us with fees, contracts and what appears to be an assumption that customers are thieves. “You must have an active account before I can give you a SIM card (for an iPad)”.

I’ve learned, now that all of my devices are unlocked, to keep their hands away from ANY changes to my account.

Further, AT&T (& Verizon) has a terrible track record on customer privacy.

And, both firms have mastered the art of political cronyism. Such tactics have a very high price. A lawyer friend, after dealing with the telcos mentioned that she “hates capitalism”. I corrected her: cronyism.

Enter Apple’s SIM.

My recent purchase of an iPad Air 2 (from Apple) offered what I thought was an opportunity to give T-Mobile a try and, if displeased by the service, switch back to AT&T (I did not consider Sprint after chatting with friends who have tried their service).

I turned on T-Mobile’s service using the iPad’s simple cellular data signup service. The first few days were uneventful. T-Mobile offered reasonable LTE service at my office, a client’s facility and home. The signal strength appeared to be less robust than AT&T’s, but the service was adequate. I further used T-Mobile’s LTE service for a four hour meeting, without issue.

Unfortunately, the next day’s four hour meeting was quite disappointing. T-Mobile only offered 4G (3G) service. LTE was nowhere to be found. Note that my geographic locations were identical on both days. The service ranged from unavailable to reasonable during my second meeting.

This experience was unacceptable. Back to AT&T.

Not so fast.

I “thought” that I could add an AT&T data plan to my iPad Air 2’s Apple SIM (yes, I know it is only one way when on AT&T. That is, AT&T locks the iPad’s SIM card…).

Unfortunately, AT&T “won’t activate an Apple SIM previously used on another network“.

Rather than simply adding a new plan to my iPad, I had to visit an Apple (or AT&T) store to obtain an AT&T SIM Card. I could have started with a new Apple SIM card, but one has to pay $5.00 for it while the AT&T SIM is “free”.

The Apple retail employee was friendly enough as I relayed the time waste and hassle factor that lead me to seek a new SIM card. “Yes, but it’s better for us”. Indeed, the Apple SIM certainly solves some (inventory) problems for Apple. Unfortunately, improved cellular choice and performance awaits the entry of another strong player to the US market. The AT&T and Verizon oligopoly needs a big push.

T-Mobile is not it, I’m sad to say.

Related: The $200B broadband scandal (now $400B).

“All information can be used against you in some way.”

“All information can be used against you in some way. And we have an entire generation, the first one ever, about whom everything will be known. Their entire youth is being monitored. And we don’t know what that might mean. How that might be used against them. I look at my father who is 80 and he has only known democracy for the shortest portion of his life. And that is why we have to act now. We have the power to change things. I remember how hopeless it seemed, 25 years ago, that it would ever change. But it did. And we did that. We, the people. And that is why it’s up to us Germans to tell this to the world.”

She is such a powerful, clear, impassioned voice. And it’s obvious that for her, this is personal. “I feel responsible. I feel like I look into one of those glass balls, where others see fog, I see a clear picture and I feel obliged to tell people. These are the tools of a totalitarian system. And just as you cannot be a little bit pregnant so you cannot be a little bit totalitarian without corrupting democracy. And we … in this city … we know where that ends up. We have seen the darkest times, right here.”

Poitras tells me how she has come to censor herself. “It’s not whether or not they’re watching, but the fact that you don’t know if they’re watching. You’ve internalised in some way this authority of the state.” At the end of the interview, I tell her how Snowden spoke at the Observer Festival of Ideas and how afterwards I and my colleague John Naughton asked him questions via Google Hangouts from my laptop. “Am I on the grid?” I ask her.

Salta Canyon Panorama

Tap to view the panorama. Then pan in any direction.

A gorgeous canyon with stunning colors. Well worth a visit.

July, 2014

The future of Airbnb in cities

Since its founding, in 2008, Airbnb has spearheaded growth of the sharing economy by allowing thousands of people around the world to rent their homes or spare rooms. Yet while as many as 425,000 people now stay in Airbnb-listed homes on a peak night, the company’s growth is shadowed by laws that clash with its ethos of allowing anyone, including renters, to sell access to their spaces. In this interview with McKinsey’s Rik Kirkland, Airbnb cofounder and CEO Brian Chesky explores how the company’s relationships with cities can evolve. An edited transcript of Chesky’s comments follows.

Interview transcript

Starting a revolution

It’s a currency of trust, and that used to live only with a business. Only businesses could be trusted, or people in your local community. Now, that trust has been democratized—any person can act like a brand.

Airbnb is a way that you can, when you’re traveling, book a home anywhere around the world. And by anywhere, I mean 34,000 cities in 190 countries. That’s every country but North Korea, Iran, Syria, and Cuba.

The reason we started was I was living with my roommate, Joe, in San Francisco, and I couldn’t afford to make rent. That weekend, the International Design Conference was coming to San Francisco. All the hotels were sold out. Joe had three air beds. We pulled the air beds out of the closet, we inflated them, and we called it the “Air Bed and Breakfast.”

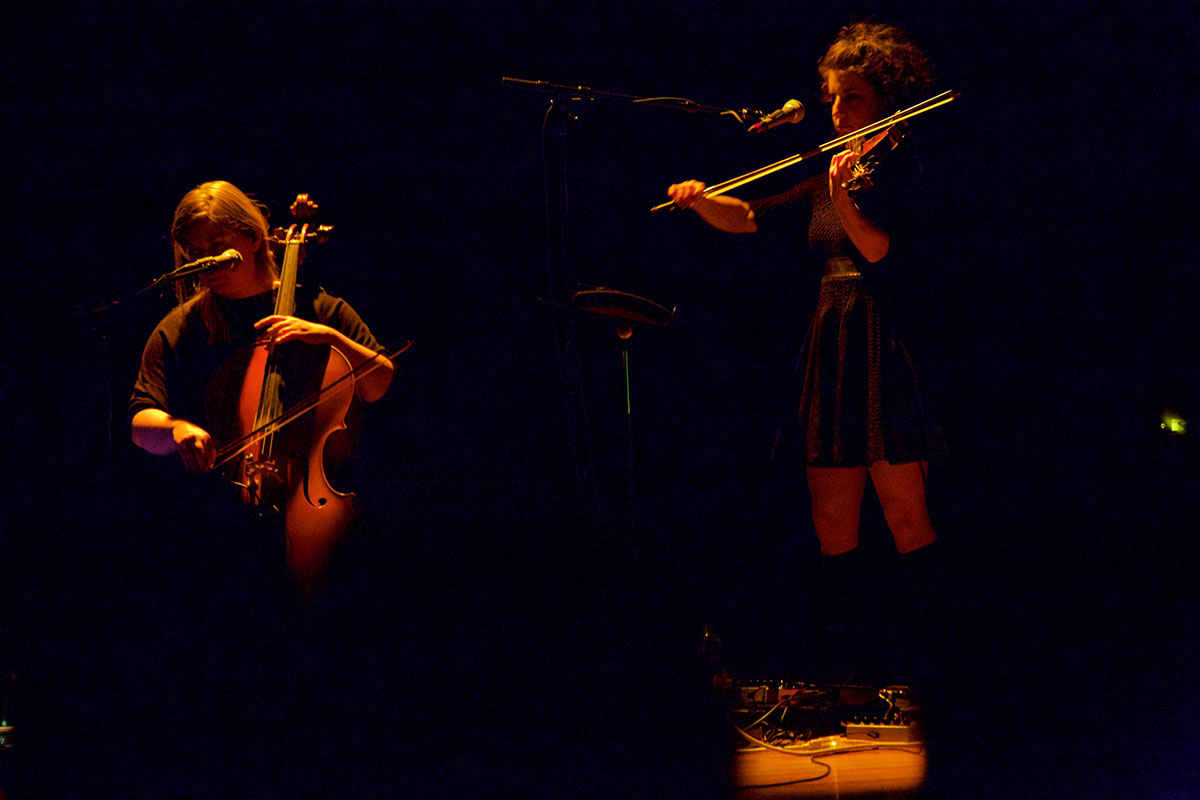

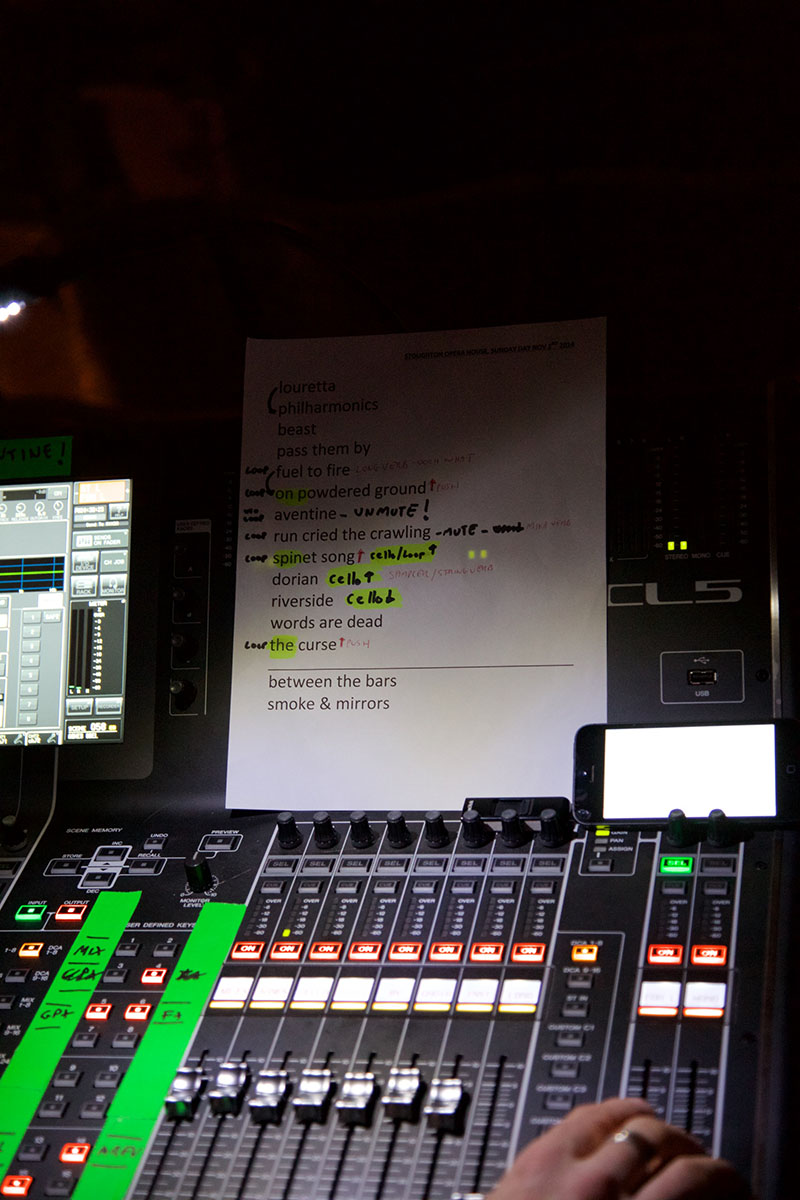

Stoughton, Berlin & Copenhagen

“Norwegian shares the same dialect as Danish”. “I will speak Norwegian with someone if you like.”

Building a name, a brand, a product, particularly one that resonates and has legs for the long haul, is work, a great deal of work. It includes playing on a pleasant Sunday evening in Stoughton, for perhaps 200 people.

The venue was built for Agnes Obel.

“Stoughton. I read in Wikipedia that it was settled by Norwegians.”

I listen to Los Angeles’s KCRW occasionally. Some years ago – ah, it was June, 2011, Agnes Obel appeared on their signature show: “Morning Becomes Eclectic”. I found her music interesting and bought a few tracks.

“This is our first time in Wisconsin.”

Glancing through Madison’s “alternative weekly” Isthmus last week, Obel’s name appeared on the upcoming events list. Sunday night. Stoughton. Opera House. Sure.

Obel’s music is not for everyone.

Yet, finding Stoughton, WI listed on her current tour along with Toronto, Minneapolis, Chicago, New York, Cambridge, Montreal, Quebec City, Brisbane, Sydney and Melbourne tells us ….. something.

I suspect she will be back, playing a larger venue. Oh, Lyle Lovett played at Madison’s Overture Center Sunday evening. $35.50 to $56.00. Obel’s $11 to $22 in Stoughton was the better value. I say that as a fan of both.

Godspeed to Obel’s entourage.

A panorama and a few photos follow:

A line in history: the east German punks behind the Berlin Wall’s most radical art stunt

On Monday 3 November 1986, a group of five masked men drew a white line on the Berlin wall. The line started at Mariannenplatz in the capital’s alternative Kreuzberg district, heading west via the Checkpoint Charlie border crossing in the city centre. At points, the line was so thick the paint dripped all the way to the bottom. Where police guarded the wall, it ran thinner, snaking down to the pavement and then back up.

After around 5km (three miles), just south of the Brandenburg Gate, opposite the square that now hosts architect Peter Eisenman’s Holocaust memorial, the line suddenly stopped. At 11:30 on Tuesday morning, border guards from the eastern side of the wall had ambushed the line-painters and put an end to their project.

Thanks to crony capitalism—the unholy alliance between business and government, in which the taxpayer gets bilked—the NFL has “created what amounts to a risk-free business environment.”

A chapter on the NFL’s business practices should make even the most ardent pigskin fan bristle. Thanks to crony capitalism—the unholy alliance between business and government, in which the taxpayer gets bilked—the NFL has “created what amounts to a risk-free business environment.” Almond provides plenty of blood-boiling examples, like the NFL’s tax-exempt status—unique among major sports leagues—and the now commonplace arrangement that sees taxpayers fund NFL stadiums while team owners reap the economic rewards. The New Orleans Saints even receive an “inducement payment” of up to $6 million a year just to keep the franchise in the city. That’s on top of the $200 million that taxpayers forked over for renovating the Mercedes-Benz Superdome—they will see none of $50 million to $60 million the team received in naming rights from the car maker.

Other chapters aren’t as strong. A chapter on race doesn’t seem fully fleshed out and lists uncomfortable questions about race and football rather than going into detail. And the connection between football and violence against women only gets four pages at the end of a chapter focusing on homophobia. The sorry history of sexual and domestic violence in high school, college, and professional football programs deserves more attention.

The thought of any large-scale exodus of fans is unlikely. TV ratings are up again this season from already astronomical levels. The continued popularity, as Almond points out, is due in part to the way the sports media promote rather than cover the game. “Sports represent one of the few growth sectors for the corporate media,” he observes. “It’s far more profitable to cover football as a glorious diversion than a sobering news story.”