When an expensive thing becomes free, new behaviors emerge. When a private thing becomes public, new behaviors emerge. Below, some thoughts on the swirling cloud of photographs that we are creating together.

We are in the middle of a redefinition of what constituents value in a photograph. On one hand, photographs are cheaper, which should lower the received value necessary to justify the taking of the photograph. On the other hand, abundance creates scarcity of attention and we now have always-on instant access to the best photographs, which devalues the amateur. Going forward, personal photographs will have two purposes: 1) memory of personal circumstance and 2) personal expression. What kinds of photographs will be taken when we have perfect information? The future photographer will ask themselves, what are the odds that this picture, but better, doesn’t exist already?

Federal Reserve & Financial Bubbles

The only way any of this makes sense is if you buy the primordial orthodox premise that monetary policy is neutral in the long run (or even intermediately). Taking that line will lead you to believe asset bubbles are just markets gone insane of their own accord. Then again, Yellen has largely been hostile to “markets” since her academic career brought some notice, so this is really no surprise. But to experience, right now, the repo market collateral shortage and QE’s direct impact and to still blame markets for lack of resilience is either inordinate impudence or targeted public relations.

I cannot overstate this enough, the selloff last year was a desperate warning about the lack of resilience in credit and funding. That repo markets persist in that is, again, the opposite of the picture Janet Yellen is trying to clumsily fashion. Central banks cannot create that because their intrusion axiomatically alters the state of financial affairs, and they know this. It has always been the idea (“extend and pretend” among others) to do so with the expectation that economic growth would allow enough margin for error to go back and clean up these central bank alterations. That has never happened, and the modifications persist.

The era of the traditional bank branch is dead

The head of the group which represents Britain’s biggest banks has called time on the traditional high street branch in the wake of the continued rise of online banking.

In a landmark series of comments, Anthony Browne, chief executive of the British Bankers Association (BBA), has admitted that “branch numbers will continue to fall” and that those who call for a return to branch banking are “out of kilter with what millions of customers want”.

Writing in The Sunday Telegraph, Mr Browne discloses that new research conducted by the BBA shows that three out of four Britons use either mobile or internet banking each month.

Pointing to the image of Dad’s Army’s Capt Mainwaring as the traditional bank manager some wish would re-emerge, Mr Brown says that the “supposed golden age of banking” is a myth. “The way we bank now is far easier and faster,” he adds.

However, Mr Browne stopped short of saying that branches will disappear altogether, highlighting their use for mortgage discussions or resolving complaints.

Persuasion: Fascinating Study Shows How To Open A Closed Mind

What’s the best way to persuade people whose beliefs stand in the way of the facts?

Let’s do a role play. I’ll be the entrepreneur. You be the jerk investor who hates my idea.

I need to persuade you I’ve invented a better mousetrap. But you, the expert, know that mousetraps are so over.

The facts say you’re wrong. Mousetrap sales are on the rise. You could look it up yourself. But you won’t, because you already know you’re right.

So how do I convince you, the know-it-all-skeptic, that I’m right and you’re wrong? Should I:

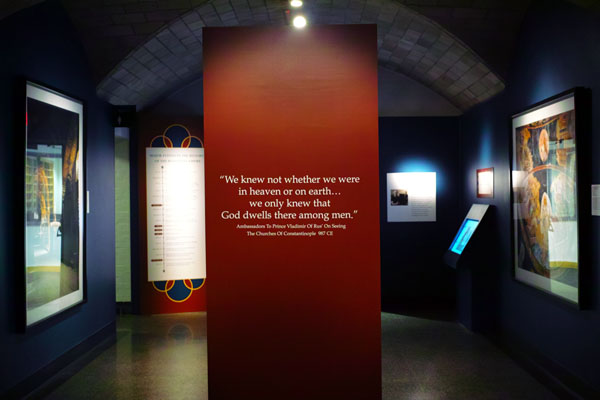

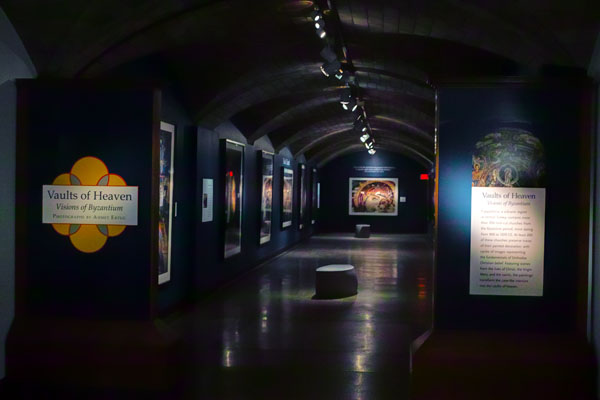

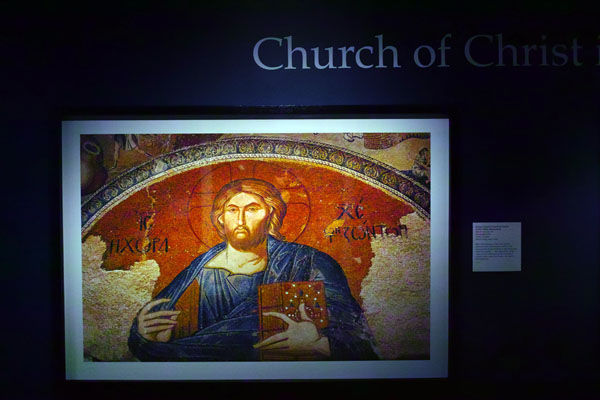

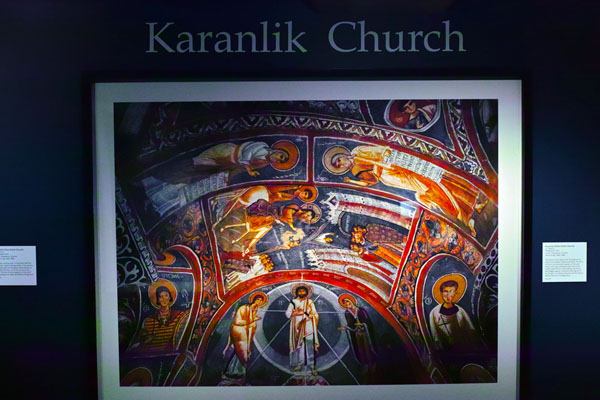

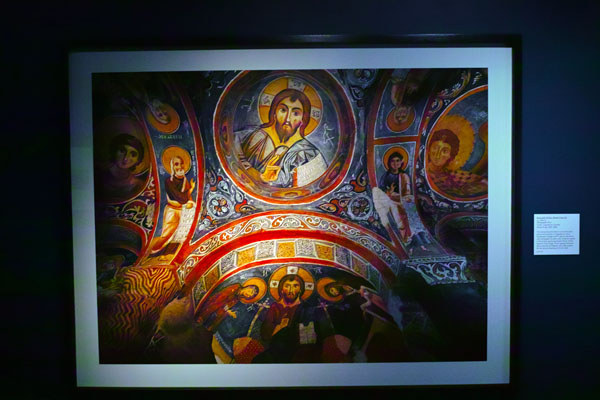

Byzantine Church Photography Exhibit at the Penn Museum

Tap to view a larger image.

The images brought back many wonderful memories of Istanbul and Cappadocia. Images, panoramas and links on a journey to Turkey.

Ahmet Ertug”s photos are worth a stop at the Penn Museum.

Ahmet”s website.

a Critique of Advertising Analytics

Ace Metrix sells marketing analytics software and competitive comparisons. Their findings generate stories, which at the same time generate PR for Ace. An excellent way to build “the new standard” in analytics.

But what exactly is the “Ace Score” of which they speak? If you have the stomach, read on.

Exposing each ad to 500 people, Ace calibrates creative effectiveness by two key measures — Persuasion and Watchability. In their own words:

“The Persuasion rating is based on the interactivity of six data elements – Desire, Relevance, Likeability, Attention, Information and Change – automatically captured and analyzed for each ad. Watchability measures the engagement that a person has with the ad. Watchability and Persuasion interact to create the Ace Score.”

This is the kind of language that gives talented people nightmares, because it often gives ammunition to people who aren’t particularly good at judging creative work.

I get that a lot of companies feel compelled to subject their ads to deep analysis. But — would you like to know how Steve Jobs analyzed an ad? He looked at it and said “I like it” or “I don’t like it.” After it ran, he gauged the reactions to it.

Ace’s type of analysis is the reason why so many companies, usually the bigger ones, begin to churn out drivel. They get more concerned with ratcheting up their “six data elements” than creating great ads.

Steve didn’t tolerate that kind of thinking. Apple’s history of great advertising is the validation of his approach.

Hospitals Are Mining Patients’ Credit Card Data to Predict Who Will Get Sick

Shannon Pettypiece and Jordan Robertson:

Imagine getting a call from your doctor if you let your gym membership lapse, make a habit of buying candy bars at the checkout counter, or begin shopping at plus-size clothing stores. For patients of Carolinas HealthCare System, which operates the largest group of medical centers in North and South Carolina, such a day could be sooner than they think. Carolinas HealthCare, which runs more than 900 care centers, including hospitals, nursing homes, doctors’ offices, and surgical centers, has begun plugging consumer data on 2 million people into algorithms designed to identify high-risk patients so that doctors can intervene before they get sick. The company purchases the data from brokers who cull public records, store loyalty program transactions, and credit card purchases.

Information on consumer spending can provide a more complete picture than the glimpse doctors get during an office visit or through lab results, says Michael Dulin, chief clinical officer for analytics and outcomes research at Carolinas HealthCare. The Charlotte-based hospital chain is placing its data into predictive models that give risk scores to patients. Within two years, Dulin plans to regularly distribute those scores to doctors and nurses who can then reach out to high-risk patients and suggest changes before they fall ill. “What we are looking to find are people before they end up in trouble,” says Dulin, who is a practicing physician.

For a patient with asthma, the hospital would be able to assess how likely he is to arrive at the emergency room by looking at whether he’s refilled his asthma medication at the pharmacy, has been buying cigarettes at the grocery store, and lives in an area with a high pollen count, Dulin says. The system may also look at the probability of someone having a heart attack by considering factors such as the type of foods she buys and if she has a gym membership. “The idea is to use Big Data and predictive models to think about population health and drill down to the individual levels,” he says.

Related: Making pizza delivery more efficient.

Facebook Could Decide an Election Without Anyone Ever Finding Out

On November 2, 2010, Facebook’s American users were subject to an ambitious experiment in civic-engineering: Could a social network get otherwise-indolent people to cast a ballot in that day’s congressional midterm elections?

The answer was yes.

The prod to nudge bystanders to the voting booths was simple. It consisted of a graphic containing a link for looking up polling places, a button to click to announce that you had voted, and the profile photos of up to six Facebook friends who had indicated they’d already done the same. With Facebook’s cooperation, the political scientists who dreamed up the study planted that graphic in the newsfeeds of tens of millions of users. (Other groups of Facebook users were shown a generic get-out-the-vote message or received no voting reminder at all.) Then, in an awesome feat of data-crunching, the researchers cross-referenced their subjects’ names with the day’s actual voting records from precincts across the country to measure how much their voting prompt increased turnout.

Overall, users notified of their friends’ voting were 0.39 percent more likely to vote than those in the control group, and any resulting decisions to cast a ballot also appeared to ripple to the behavior of close Facebook friends, even if those people hadn’t received the original message. That small increase in turnout rates amounted to a lot of new votes. The researchers concluded that their Facebook graphic directly mobilized 60,000 voters, and, thanks to the ripple effect, ultimately caused an additional 340,000 votes to be cast that day. As they point out, George W. Bush won Florida, and thus the presidency, by 537 votes—fewer than 0.01 percent of the votes cast in that state.

Moaning Moguls

The past few years have been very good to Stephen Schwarzman, the chairman and C.E.O. of the Blackstone Group, the giant private-equity firm. His industry, which relies on borrowed money, has benefitted from low interest rates, and the stock-market boom has given his firm great opportunities to cash out investments. Schwarzman is now worth more than ten billion dollars. You wouldn’t think he’d have much to complain about. But, to hear him tell it, he’s beset by a meddlesome, tax-happy government and a whiny, envious populace. He recently grumbled that the U.S. middle class has taken to “blaming wealthy people” for its problems. Previously, he has said that it might be good to raise income taxes on the poor so they had “skin in the game,” and that proposals to repeal the carried-interest tax loophole—from which he personally benefits—were akin to the German invasion of Poland.

The IPO is dying. Marc Andreessen explains why

This is so powerful in the conventional wisdom right now. I love the Daily Show like everyone else does. But literally [Jon Stewart’s] answer to every issue is Congress should pass a law. [People think you can] solve any problem by passing enough laws.

I don’t see the world getting less dramatic. I don’t see the world calming down.

The loop we’re in now is that people are getting upset and disappointed by the stock market. There are no growth stocks, which means there’s no growth. Stock market returns have been weak for 15 years, which is exactly what you’d expect if you took all the growth out. Everyone is upset the stock market isn’t performing. The worse the results get, the more regulation you get. It’s in its own kind of doom loop. Unless something happens to shock the system a lot, our assumption is it gets worse, not better.