High-income economies have had ultra-cheap money for more than five years. Japan has lived with it for almost 20. This has been policy makers’ principal response to the crises they have confronted. Inevitably, a policy of cheap money is controversial. Nonetheless, as Japan’s experience shows, the predicament may last a long time.

The highest interest rate charged by any of the four most important central banks in the high-income economies is 0.5 per cent at the Bank of England. Never before this period had the rate been below 2 per cent. In the US, the eurozone and the UK, the central bank’s balance sheet is now close to a quarter of gross domestic product. In Japan, it is already close to half, and rising. True, the Federal Reserve is tapering its programme of asset purchases, and there is talk that the BoE will soon tighten policy. Yet in the eurozone and Japan the question is whether further easing might be needed.

What Target and Co aren’t telling you: your credit card data is still out there

Target wants you to know that you can trust it again. Nearly seven months after the second biggest retailer in America ignored multiple alarm bells, allowing thieves to virtually hijack the cash registers at some 1,800 stores and siphon at least 40m credit and debit card records plus contact info for more than 70m customers, CEO Gregg Steinhafel is out, and the company has pledged to spend $100m upgrading the security of its checkout system.

But Monday’s mea culpa papers over problems still endemic throughout the American retail industry: an over-reliance on in-store technology rather than cybersecurity experts in the boardroom, and a tendency to underestimate the lengths to which bad guys will go to steal anything that isn’t properly nailed down.

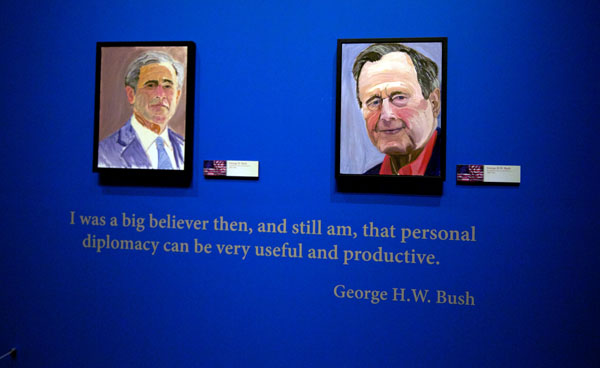

George W Bush Presidential Library Panorama & Photos

A recent conference included an interesting visit to the George W. Bush Presidential Library.

Still Images

iPhone 5c Outdoor Advertising: Downtown Dallas, TX

While on travel recently, I wondered a bit around downtown Dallas and found the massive iPhone 5c advertisements interesting. Aimed at nearby freeway traffic, the Apple imagery was “complemented” by similar “fast follower” Samsung placements. I noticed the Samsung advertisements during a later drive. However, I lacked the time to photograph them.

Samsung’s USA mobile phone business is headquartered in nearby Plano.

Tap on the images below to view larger versions.

The Apple advertisements’ location can be seen in context via this iOS maps app screenshot:

Bitcoin and the Dólar Blue in Argentina

The US dollar black market doesn’t just thrive in Buenos Aires, it’s published in the paper every morning. Swinging by one of the city’s newsstands, you’ll find the official peso to dollar rates published next to the ‘dólar blue’ rates at the top of the morning edition of La Nacion, and if you walk downtown to Calle Florida, the arbolitos that stand planted on the busy commercial street greet any foreigner they see with barks for “Cambio! Cambio! Cambio!” Currency restrictions have gotten more stringent in Argentina in recent years as the government struggles to prop up confidence in the peso by restricting the dollar. The restrictions have held the official rate down to around 8 to 1, but the blue rate at around 10 to 1 is so favorable that dollars determine tourism prices and denominate everything from technology purchases to property.

Apps will be used in healthcare ‘as often as antibiotics’

Bruce Hellman is determined to move away from a healthcare system in which every appointment begins with “a blank picture where clinicians have no insight on how their patients are doing”.

He is, he said at Wired Health today, astounded that when he goes to an ecommerce site it will know all about how he has been spending his money since his last visit; when he visits his GP after a six-month break, they will have practically nothing on him and what he has been doing during that time.

Menu-data startup Food Genius finds there are no national food trends, only local ones

There was only one problem. The data they found was not what what they expected to find.

After aggregating menu data for more than a year, Food Genius wasn’t able to find any big nationwide food or eating trends. No matter what it looked at – the appearance of kale on the menu, the number of restaurants serving carnitas tacos – Food Genius was just seeing big flat lines across its graphs. The problem, according CEO and co-founder Justin Massa, was that, averaged out across the country, our eating patterns stayed static or rose and fell only incrementally quarter to quarter, year to year.

Madison Sunset: Easter 2014

Biomarkers and ageing: The clock-watcher

He has discovered an algorithm, based on the methylation status of a set of these genomic positions, that provides a remarkably accurate age estimate — not of the cells, but of the person the cells inhabit. White blood cells, for example, which may be just a few days or weeks old, will carry the signature of the 50-year-old donor they came from, plus or minus a few years. The same is true for DNA extracted from a cheek swab, the brain, the colon and numerous other organs. This sets the method apart from tests that rely on biomarkers of age that work in only one or two tissues, including the gold-standard dating procedure, aspartic acid racemization, which analyses proteins that are locked away for a lifetime in tooth or bone.

“I wanted to develop a method that would work in many or most tissues. It was a very risky project,” Horvath says. But now the gamble seems to be paying off. By the time his findings were finally published last year1, the clock’s median error was 3.6 years, meaning that it could guess the age of half the donors to within 43 months for a broad selection of tissues. That accuracy improves to 2.7 years for saliva alone, 1.9 years for certain types of white blood cell and 1.5 years for the brain cortex. The clock shows stem cells removed from embryos to be extremely young and the brains of centenarians to be about 100.

RIP for OED as world’s finest dictionary goes out of print

It’s all academic for now anyway, they say, because the third edition of the famous dictionary, estimated to fill 40 volumes, is running at least 20 years behind schedule.

Michael Proffitt, the OED’s first new chief editor for 20 years, said the mammoth masterpiece is facing delays because “information overload” from the internet is slowing his compilers.

His team of 70 philologists, including lexicographers, etymologists and pronunciation experts, has been working on the latest version, known as OED3, for the past 20 years.

Michael Proffitt revealed to Country Life magazine that the next edition will not be completed until 2034, and likely only to be offered in an online form because of its gargantuan size.

“A lot of the first principles of the OED stand firm, but how it manifests has to change, and how it reaches people has to change,” said the 48-year-old Edinburgh-born editor.

Work on the new version, currently numbering 800,000 words, has been going on since 1994. The first edition, mooted in 1858 with completion expected in 10 years, took 70 years.

“Although the internet has made access easier,” said Mr Proffitt, “it’s also created the dilemma of information overload.