“Putting together the pipelines,” was how Pfizer chief executive Ian Read explained his proposed takeover of British drugmaking rival AstraZeneca.

“Let’s make sure we get good capital allocation… build a culture of ownership… flexible use of financial assets… productive science… opportunity to domicile… putting together the headcount,” were among his phrases as he faced MPs last month, much to the frustration of committee members.

“I asked a simple question,” committee chairman Adrian Bailey said at one point.

Use of jargon is not a new phenomenon, but businesses are leaving their customers and even their own staff scratching their heads about where their firms are going and where they themselves stand.

“This jargon is tribal and reinforces belonging,” says Alan Stevens, director of Vector Consultants, which advises companies on culture. “It’s part of the psyche. But it’s not useful.”

TV Rights Spaghetti: Sports App User Experience and the French Open

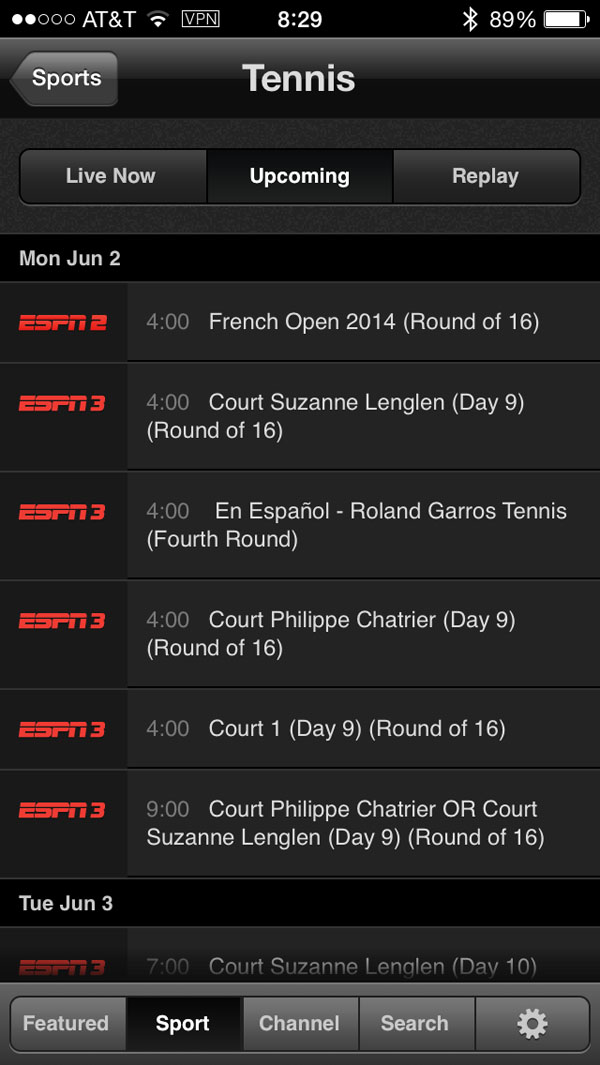

A tennis Dad and occasional recreational player, I enjoy watching a few pro tour matches. The French Open beckoned Saturday morning so I tapped the “WatchESPN” iOS app, tapped “Tennis” and….. saw no live events until Monday!

Strange.

I knew the French Open was underway, + 7 hours from my Madison home.

So began a quick survey of sports television rights spaghetti, one that included four apps!

I set my “virtual location” to Espoo, Finland using F-Secure’s “Freedome” VPN app. I then installed the French Open app seeking a live court by court video stream. Alas, I was unsuccessful. Perhaps the secret is buried deep in the app, but I failed to find it.

I searched online a bit to see if there were other apps streaming the event, but, after a few minutes gave up and moved on.

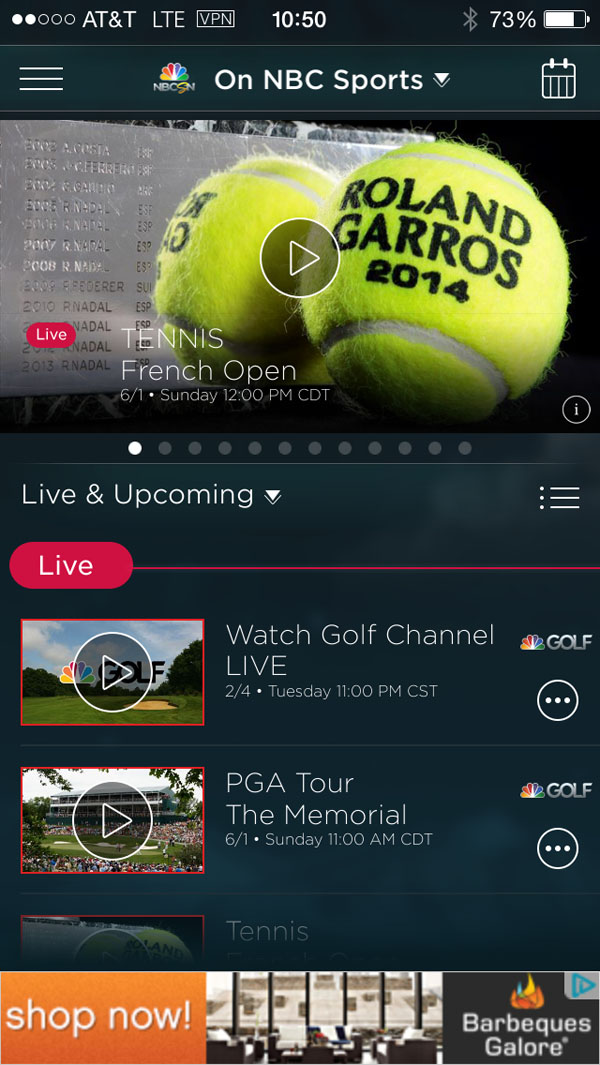

A “major” tv network must have acquired certain rights to the French Open, and indeed, in the States, NBC (parent, GE) is it.

I installed the NBC Sports app and found that a live stream + commercials was available from 11:00a.m. CDT to 2:00p.m. CDT. (The Murray – Kohlschreiber match went late and continued the next day). NBC’s sportscasters cut to hockey several times and later apologized that they would stay with tennis and go to a College Rugby contest when the Murray – Kohlschreiber match was complete that evening (afternoon).

The NBC Sports App mirrored broadcast TV’s schedule….. Astonishingly, the tennis fan who wished to see other matches, mostly earlier in the day, could not view any events beyond those available on broadcast tv. In fact, they did not exist within NBC’s app.

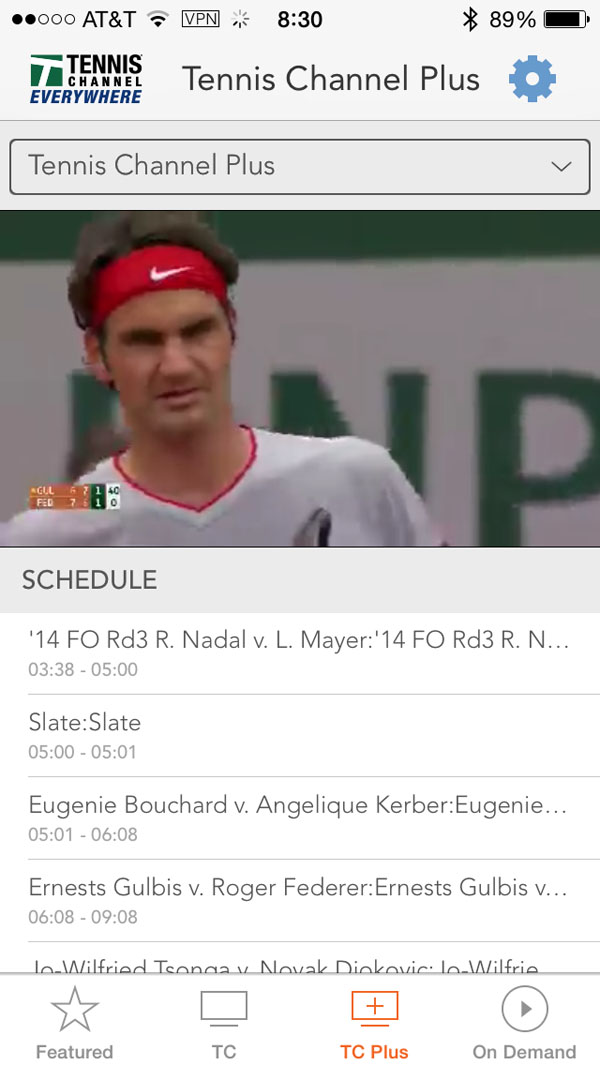

My last resort: the Tennis Television App. I tried it last year and learned that the world stands still. The Tennis Television app streams a portion of certain events ($59.99 in app purchase) while “WatchESPN” offers others. Both are pre-empted by “major” networks acquiring what appear to be exclusive rights for certain matches and/or time windows.

This user experience pain reveals both an opportunity and a major challenge for anyone trying to improve the tv experience. Byzantine rights and an obvious thick legacy infrastructure make change rare. Further, the WatchESPN app is “sandboxed”, that is it requires users to “authenticate” via their cable provider.

Oh, the humanity.

I’ve wondered how Steve Jobs passing might affect Apple’s ability to cut deals for its TV initiative. His reality distortion field was a well known asset when schmoozing others from Ross Perot to music industry players. *

My Saturday French Open app odyssey informs us that big opportunities remain, but much difficult deal making lies ahead. Might Apple’s new players be up to the challenge?

* I remain somewhat surprised that Apple has been unable to cut an interesting deal with Disney for ESPN. Jobs’ estate is a significant shareholder via the sale of Pixar to Walt’s Company in 2006.

Financial Hazards of the Fugitive Life

You may think of being on the run as a quandary for only a small group of recalcitrant, hardened criminals. But in her study of one Philadelphia neighborhood, Professor Goffman shows that it is a common way of life for many nonviolent Americans. These people often face charges related to possession or sale of small amounts of drugs, or offenses like hiding relatives from the law. Whatever the negative moral implications of such crimes, they don’t merit having one’s life ruined.

A core point of “On the Run” is that “young men’s compromised legal status transforms the basic institutions of work, friendship and family into a net of entrapment.” For instance, the police round up fugitives by monitoring and contacting their relatives — and that frays family relations. A young man might avoid showing up at the hospital to witness the birth of his child because he knows he could be caught or turned in. Family gatherings become another hazard, so in-person appearances are often surprise visits. People stuck in this kind of limbo are also reluctant to visit hospitals when they need treatment, and a result, the book says, is a “lifestyle of secrecy and evasion,” driven by the unfavorable incentives set in motion by the law.

Why IBM Is In Decline

It’s been a striking week for IBM. In its June 2014 issue, Harvard Business Review (HBR) published an interview with IBM’s former CEO Sam Palmisano, in which describes how he triumphantly “managed” investors and induced IBM’s share price to soar.

But IBM also made it to the front cover of Bloomberg Businessweek (BW) with a devastating article: “The Trouble With IBM.” According to BW, Palmisano handed over to his unfortunate successor CEO, Ginni Rometty, a firm with a toxic mix of unsustainable policies.

The key to Palmisano’s success in “managing” investors at IBM was—and is–“RoadMap 2015”, which promises a doubling of the earnings per share by 2015. The Roadmap is what induced Warren Buffett to invest more than $10 billion in IBM in 2011, along with many other investors, who were impressed with the methodical way in which IBM was able to make money. (Buffett’s investment was striking because of his long-standing and publicly announced aversion to investing in technology, which he confessed he didn’t understand.)

After all, IBM under Palmisano had doubled earnings per share in Roadmap 2010, and now it is “on track” to do the same by 2015 under the leadership of Ginni Rometty, another long-time IBMer, who took over as CEO in 2012. She has embraced the Roadmap with as much gusto as her predecessor.

Yet for critics of IBM like BW, “Roadmap 2015” is precisely what is killing IBM. According to BW, IBM’s soaring earnings per share and its share price are built on a foundation of declining revenues, capability-crippling offshoring, fading technical competence, sagging staff morale, debt-financed share buybacks, non-standard accounting practices, tax-reduction gadgets, a debt-equity ratio of around 174 percent, a broken business model and a flawed forward strategy.

The ‘Great Wave’ that reached the West

Ukiyo-e prints could be found in Europe from at least 1795 at the Cabinet des Estampes at the Bibliotheque Nationale in Paris. It was not until the 1850s, however, when trade between Japan and Europe began to flourish, that the craze for things Japanese began to crescendo.

The story goes that French printmaker Felix Bracquemond (1833-1914) encountered a picture-book by Katsushika Hokusai (1760-1849) that arrived in France with a shipment of porcelain in the late 1850s. In 1859, a sourcebook by the potter and designer Eugene Collinot and Adalbert de Beaumont included Hokusai’s imagery.

By the early 1860s, French intellectuals such as Charles Baudelaire and Edmond de Goncourt began to take interest. And that most internationally recognizable Hokusai print, commonly called the “Great Wave,” has now come to stand allusively for the surge of European interest in Japanese printmaking that emerged from the latter half of the 19th century.

Want to spot the next bubble? Look at where Harvard grads work

Everybody wants to know what the next bubble is, and there’s an easy way to tell: Just watch where Harvard grads are going. Then short the hell out of that.

It’s called the Harvard M.B.A. Indicator — though it applies to undergrads, too — and it’s one part psychology, another part economics. The idea is simple enough: It’s a bad sign when more Harvard grads go to Wall Street.

Harvard is a magnet for Organization Kids who excel at coloring between the lines. After graduation, they want to do something prestigious, something remunerative, but mostly, as Kevin Roose points out, something that gives them new lines to color between. That might be Silicon Valley, or it might be Teach for America — or it might be Wall Street, if, that is, the getting looks good.

“His ignorance freed him from the assumptions that dominated the industry”

Mr Munk’s greatest gamble was his move into mining when he founded Barrick in 1983. He knew little about the business at the time—just as he had known little about hotels before that. But his ignorance freed him from the assumptions that dominated the industry. It was mostly run by geologists and engineers whose aim was to dig enormous holes with other people’s money, paying little regard to shareholder returns. Gold miners were supposed to be “believers” in gold rather than efficient managers out to maximise profits. “Bullshit,” thought Mr Munk; he soon changed all that. A string of ever-more audacious acquisitions turned Barrick into what was for a while the world’s largest gold miner and is still among the biggest.

Mr Munk also turned out to be a first-rate manager of his growing business empire. He may have been willing to overrule old hands when it came to whether mining should be run by managers or miners—and do it with absolute self-confidence that brooked no question. But he was also willing to delegate operational decisions to experts. Indeed, he explicitly refused to micromanage, to give himself time to think big thoughts.

Survivor

On China’s Property Bubble

Attempts to bail out the property market are unlikely to succeed. China’s property market is a bubble in both volume and price. Oversupply, especially in small cities, is destroying the expectation of price appreciation. Speculation cannot be revived. Household indebtedness is close to saturation. The high prices in large cities cannot be sustained by debt growth. Bailout attempts, such as eliminating purchase restrictions, will only backfire, as the restrictions do not suppress demand in the first place.

The property market could follow the example of the A-share market. Bailout attempts have less and less impact. The market eventually dies when people no longer pay attention to it.

Allowing prices to adjust is the best policy. The distortions in the economy due to the bubble shrink. The efficiency of the economy improves as a result. The improving efficiency leads to better labor income, which supports the virtuous cycle of rising wages and rising consumption.

The myth of the science park economy

Paul Nightingale and Alex Coad.:

Over the last 30 years innovation and entrepreneurship have become increasingly prominent concerns for successive UK governments. And yet our record is mixed, to say the least. The economist David Storey has calculated that we spend about £8bn a year supporting small firms in the UK. Having spent this money we should be asking: where are our Googles?

Innovation is often seen as originating from university research, which then migrates into start-ups incubated in science parks, before moving out into the wider world. There is also financial support to create geographically concentrated ‘clusters’ of networked, innovative small firms. But how many new global firms has the UK produced in recent years? A handful perhaps, ARM, Imagination Technologies, CSR, and the recently acquired DeepMind and Natural Motion are all excellent firms, but not yet at the level of Google, Apple or Cisco.

This is not just a British problem. In Europe and the US it is probably fair to say that there is not a single example of a successful cluster that has been created by government intervention.