A few years ago, senior officials at the Bank for International Settlements started ringing alarm bells about the scale of leverage that was quietly building up in the financial system. Back then, though, it was fantastically hard to get American policymakers – let alone bankers – to listen.

In the go-go days of the credit bubble, Washington policymakers blithely assumed that the Western financial system had plenty of capital to cope with any potential risks. Consequently, as one former BIS official admits: “Worrying about leverage wasn’t fashionable at all – no one wanted to hear.”

Fast-forward a couple of years and, my, how those Western financiers are having to eat humble pie (even to the point of accepting a helping hand from the once-ailing Japanese). After all, the events of the past year have now made it patently – horrifically – obvious that the Western banking system has become dangerously undercapitalised in recent years, to the point where even the Federal Reserve is having to shore up its defences.

Moreover, it is now also clear that Western policymakers are belatedly trying to correct this state of affairs. The days when high leverage, mega bonuses and wacky instruments were equated with financial virility have gone; instead a more humble, back-to-basics and slim-line approach is what investors are demanding. Thus, deleveraging is now all the rage – in whatever form it might take.

Category: Politics

Five Reasons to Give Thanks for the Financial Collapse of the Decade

One of life’s rules is that there’s bad in good and good in bad. The total collapse of the U.S. financial system is no exception. Even in the midst of the current financial despair we can look around and identify many collateral benefits.

A lot of attractive office space seems to be opening up in midtown Manhattan, for instance, and the U.S. government is now getting paid to borrow money. (And with T-bills yielding 0 percent, they really ought to borrow a lot more of it, and quickly.)

And so as Morgan Stanley Chief Executive Officer John Mack blasts short sellers for his problems, and Goldman Sachs CEO Lloyd Blankfein swans around pretending to be above this little panic, we ought to step back and enjoy the positives.

Justice Wheels in Madison

The Presidential Contest in Wisconsin

TAMMY WYNEN stands near the back of a crowd outside a paper mill in Kimberly, Wisconsin. At a bank of microphones, speakers rail against Adam Smith; one, from the United Steel Workers, literally blames “The Wealth of Nations” for the mill’s impending closure. Many also hint that the soon-to-be unemployed mill workers should vote for Barack Obama in November.

But Mrs Wynen, a 27-year veteran of the paper mill, is not so sure. She cannot remember the last time she saw Mr Obama recite the pledge of allegiance. And her family loves Sarah Palin, John McCain’s new running-mate. Her children have lines from Mrs Palin’s convention speech off pat. Still, Mrs Wynen says she doesn’t know who she will vote for. The candidates look poised to spend a lot of time and money in Wisconsin wooing her.

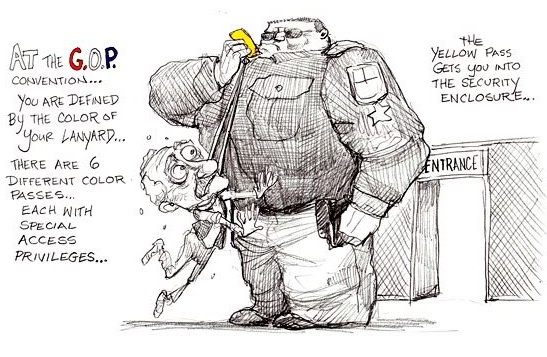

KAL Illustrations at the Republican Convention

The Economist. Democrat convention illustrations can be found here.

Great stuff.

Obama 12 Sighting

Driving the speed limit early this morning, a dark blue car with flags zoomed past. A blur on my left. The nearby stop light provided an opportunity to take this photo.

Obama 12? Does it imply there are numbers 1 to 11 driving around? Or, is it a play on Adam 12? One needs to be of a certain age to recall the TV series Adam 12.

Finally, the car is a new Chevy Malibu. It’s interesting that there is no mention of Joe Biden on the flags, stickers or plate, which is perhaps, for the best.

Privatizing What the Public Paid For

“Right. It takes unconventional and courageous thinking to come up with a plan that clears a highway lane for the well off, while the middle class and working poor are left to inhale each other’s $5-a-gallon exhaust fumes. The worst thing about this ill-conceived decision … is it allocates freedom of movement according to income.”

— From “Diamond Lanes for the Rich,” by Tim Rutten (Los Angeles Times, April 26, 2008)

Few think of it this way, but America already has a major flat tax that we all pay equally: the 18.4-cent federal tax that is applied to each and every gallon of gasoline we purchase, or the 24.4 cents on every gallon of diesel. Say a young person, who just lost his job at McDonald’s, buys a gallon of gas to get to an interview at Burger King at the same time Warren Buffet buys a gallon of gas to get to the airport in Omaha to board his personal jet: Both the unemployed, below-minimum-wage worker and America’s richest billionaire contribute the exact same amount toward the nation’s highway system on that day.

Now, however, we are being told – to an increasingly urgent drumbeat – that America can no longer afford the luxury of building new infrastructure or even maintaining our current road system, because there’s just no funding for these programs. It’s here that the complete absence of critical thinking about America’s future should astonish and dismay anyone who looks at the facts even casually.

Open Records Guerrilla

But if you want to download and save those laws to your computer, forget it.

The state claims copyright to those laws. It dictates how you can access and distribute them — and therefore how much you’ll have to pay for print or digital copies.

It forbids people from storing or distributing its laws without consent.

That doesn’t sit well with Carl Malamud, a Sebastopol resident with an impressive track record of pushing for digital access to public information. He wants California — and every other federal, state and local agency — to drop their copyright claims on law, contending it will pave the way for innovators to create new ways of searching and presenting laws.

“When it comes to the law, the courts have always said there can be no copyright because people are obligated to know what it says,” Malamud said. “Ignorance of the law is no excuse in court.”

Malamud is spoiling for a major legal fight.

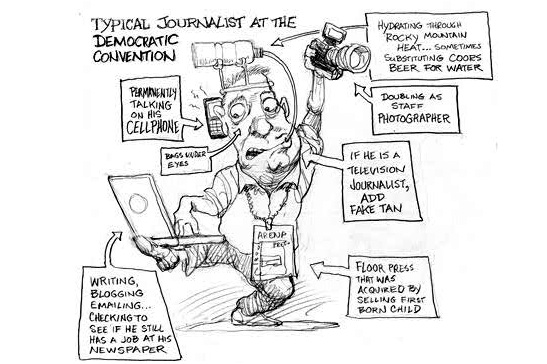

Political Cartoonist KAL at the Democratic Convention

Every day this week, our cartoonist is sending his sketches from the Democratic convention in Denver, Colorado. Sketches from previous days can be found here. You can find up-to-the-minute coverage on our American politics blog.

Dangerously in Debt

Former U.S. Comptroller General David Walker speaks out on the perils of the rising federal deficit in the new film “I.O.U.S.A.

If “An Inconvenient Truth” sounded the alarm on global warming, “I.O.U.S.A.,” a new documentary opening in theaters Friday, hopes to do the same for the rising federal deficit.

Backed by Blackstone Group Chairman Peter Peterson, “I.O.U.S.A.” follows former U.S. Comptroller General David Walker and the Concord Coalition’s Robert Bixby on a “fiscal wake-up tour” across America. In the movie, which is co-written by “Empire of Debt” co-author Addison Wiggin and directed by “Wordplay” filmmaker Patrick Creadon, Messrs. Walker and Bixby argue that unless the government alters its policies and spending habits, the U.S. will be in for a serious financial meltdown.