Since 1999, the editors of Technology Review have honored the young innovators whose inventions and research we find most exciting; today that collection is the TR35, a list of technologists and scientists, all under the age of 35. Their work–spanning medicine, computing, communications, electronics, nanotechnology, and more–is changing our world.

Category: Education

Hyperwords

A Fabulous tool for the excellent firefox web browser:

With Hyperwords™ installed in your web browser, select any text and a menu appears: searches, references, emailing, copying, blogging, translation, & more

Venturesome Consumption

Fascinating article in a recent Economist:

In a marvellously contrarian new paper*, Amar Bhidé, of Columbia University’s business school, argues that these supposed remedies, and the worries that lie behind them, are based on a misconception of how innovation works and of how it contributes to economic growth. Mr Bhidé finds plenty of nice things to say about many of the things that most trouble critics of the American economy: consumption as opposed to thrift; a plentiful supply of consumer credit; Wal-Mart; even the marketing arms of drug companies. He thinks that good managers may be at least as valuable as science and engineering graduates (though given where he works, perhaps he is talking his own book). But he has nothing nice to say about the prophets of technological doom.

* “Venturesome Consumption, Innovation and Globalisation”, presented in Venice at the CESifo and Centre on Capitalism and Society conference, July 21st-22nd.

A Look at the UW’s “Broad” Stem Cell Patents

Antonio Regalado & David Hamilton:

The broadly worded patents, which cover nearly any use of human embryonic stem cells, are held by the Wisconsin Alumni Research Foundation, a nonprofit group that handles the school’s intellectual-property estate, managing a $1.5 billion endowment amassed during 80 years of marketing inventions.

John Simpson, an official at the foundation bringing the challenge, says WARF’s efforts to enforce its patents are “damaging, impeding the free flow of ideas and creating a problem.” Mr. Simpson’s group got involved in the dispute earlier this year after Wisconsin officials said they would demand a share of state revenue from California’s voter-approved stem-cell initiative.

WARF doesn’t charge academics to study stem cells, but it does ask commercial users to pay fees ranging from $75,000 to more than $250,000, plus annual payments and royalties. So far, 12 companies have licensed rights from WARF to use the cells, and more than 300 academic laboratories have agreements to use the technology without charge. WARF spokesman Andy Cohn declined to say how much the organization has earned from the patents so far but says it is less than what it has spent funding stem-cell research and paying legal costs.

McCurrencies

Happy 20th birthday to our Big Mac index.

WHEN our economics editor invented the Big Mac index in 1986 as a light-hearted introduction to exchange-rate theory, little did she think that 20 years later she would still be munching her way, a little less sylph-like, around the world. As burgernomics enters its third decade, the Big Mac index is widely used and abused around the globe. It is time to take stock of what burgers do and do not tell you about exchange rates.

The Economist’s Big Mac index is based on one of the oldest concepts in international economics: the theory of purchasing-power parity (PPP), which argues that in the long run, exchange rates should move towards levels that would equalise the prices of an identical basket of goods and services in any two countries. Our “basket” is a McDonald’s Big Mac, produced in around 120 countries. The Big Mac PPP is the exchange rate that would leave burgers costing the same in America as elsewhere. Thus a Big Mac in China costs 10.5 yuan, against an average price in four American cities of $3.10 (see the first column of the table). To make the two prices equal would require an exchange rate of 3.39 yuan to the dollar, compared with a market rate of 8.03. In other words, the yuan is 58% “undervalued” against the dollar. To put it another way, converted into dollars at market rates the Chinese burger is the cheapest in the table.

BABY LEFT FOR DEAD IS ALL GROWN UP

The temperature outside on the night of Dec. 30, 1987, was 45 and dropping. Cold for most anyone, but perilous for a newborn baby girl wrapped in a towel and stuffed in a brown paper bag like trash.

She probably wasn’t meant to be found alive.

When Steve Gibbons, a California Highway Patrol officer, pulled off Interstate 280 to stop and stretch his legs, she was just hours old. Her temperature had plummeted to a dangerous 90 degrees. If she had been there much longer, she would have died near the intersection of Cañada and Edgewood roads in Redwood City.

But Gibbons heard the baby’s cry.

Don’t Stop….Start

If you want to change something in your life, it’s common to try to stop the behaviors you don’t like. While this certainly seems logical, it seldom works. The reason is simple – it unintentionally creates a vacuum where the old behaviors used to be. And since nature hates a vacuum it will fill it with anything it can find – usually the very behaviors you’re trying to stop since they’re so familiar. Instead of stopping certain behaviors, try focusing on what you want to create – and the new behaviors you need to get there. Eventually, with practice, new behaviors will develop enough muscle to naturally replace the old ones.

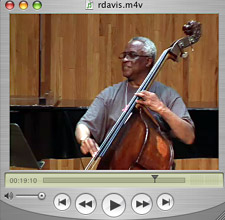

Richard Davis’s Birthday Party: Audio / Video

Often in life, the best things are free. Thanks, Richard and friends! |

Richard Davis’s Friday night Birthday Bash (Richard mentioned that his birthday is actually tax day, April 15) seemed an appropriate way to wrap up a beautiful Madison week, with temperatures reaching into the 70’s. The bash was held Friday night at Mills Hall and included participants from the Bass Conference Faculty.

Audio / Video:

Conference pictures are available here. |

UW Grad Carol Bartz Offers Tech CEO Advice

Carol Bartz has outlasted most CEOs of big companies. She has been chief executive of Autodesk for the past 14 years, when the median tenure is just five years. She led the Silicon Valley software company through economic ups and downs. In May, Ms. Bartz will relinquish her CEO post and become executive chairman. But her longevity as CEO gives her a rare perspective on what it takes to weather mistakes and business cycles and to be an agent of change.

Don’t rest on your honeymoon-period laurels.

When she first became CEO, Ms. Bartz joked that her task was “playing Wendy to the Lost Boys of Autodesk.” The company had one product, profits were sagging and employees, who brought their dogs and cats to the office, weren’t used to answering to anyone. Even by Silicon Valley standards, the atmosphere was chaotic, choking creativity.

What’s the Biggest Change Facing Business in the Next 10 Years?

In Fast Company’s first decade, we introduced readers to a lot of amazingly smart people. To launch our second, we asked 10 of our favorite brains what’s next–and how to get ready for it.

I think Malcolm Gladwell nails it, business will become much more active in political issues:

“Business has to find its national voice. It has to be engaged in the politics of this country in a way it’s not accustomed to. Right now, executives are very good at saying, ‘Cut our taxes, cut our regulations.’ And they’re really terrible at making far more important and substantive arguments about social policy. It’s time they stopped banging this one-note drum and started saying that a lot of the things that have been relegated to ideology are, in fact, matters of fundamental international competitiveness for this country.

Take, for example, health care. We are ceding manufacturing jobs to the rest of the world because we can’t get around to providing some kind of basic, uniform health insurance. Because of our strange ideological problem with nationalized health insurance, we’re basically driving Detroit out of business–which strikes me as a very counterintuitive, nonsensical policy. The simple fact is that GM and Ford and Chrysler cannot compete in the world market if they’re asked to bear the pension and health-care costs of their retirees. Can’t be done. It’s that simple.