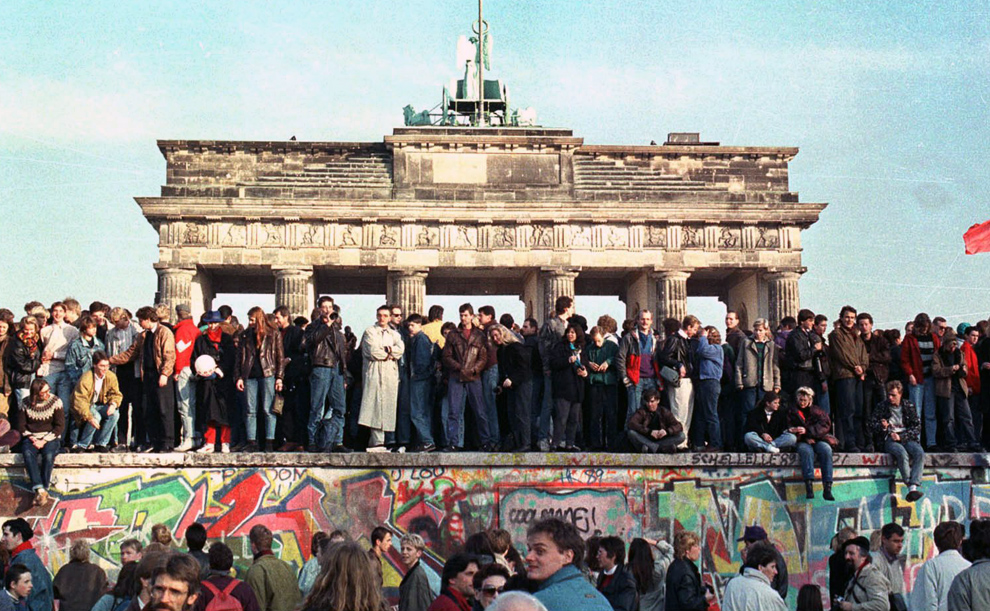

Twenty years ago, on the night of November 9, 1989, following weeks of pro-democracy protests, East German authorities suddenly opened their border to West Germany. After 28 years as prisoners of their own country, euphoric East Germans streamed to checkpoints and rushed past bewildered guards, many falling tearfully into the arms of West Germans welcoming them on the other side. Thousands of Germans and world leaders gathered in Berlin yesterday to celebrate the “Mauerfall” – the dismantling of the Berlin Wall and German reunification – and to remember the approximately 100-200 who died attempting to cross the border over the years. Collected here are photographs both historic and recent, from the fall of the Berlin Wall. Be sure to pause on photos 12 – 15, and click them to see a fade effect from before to after. (38 photos total)

Category: History

Playing with fireForget China, the US Federal Reserve is the world’s biggest currency manipulator

As US President Barack Obama glided through China, a chorus erupted in New York and Washington: the problem with the global economy is China’s exchange-rate policy, and Obama’s No 1 job is to slay it. It’s sad that these people actually believe what they are saying: the same “logic” got the world into the current mess. In the feverish hallucination of salvation, they think that moving China’s currency policy would right all wrongs.

The US Federal Reserve is the biggest currency manipulator in the world. Not only does it keep the short-term interest rate at zero through its vast purchase programme for mortgage-backed securities, it also keeps credit spreads and bond yields artificially low. Its manipulation stops money, bond and credit markets from pricing either the Fed’s policy or the US economic plight. All the firepower is packed into the currency market, giving speculators a sure bet on a weaker dollar and everything else rising. Here comes the biggest carry trade ever: the Fed is promising no downside for shorting the dollar.

The US Treasury writes an annual report, judging if other countries are manipulating their exchange rates. It should look in the mirror. Even though the Fed is not directly intervening in the currency market per se, its manipulation is equivalent to pushing down the dollar by non-market means.

Playing with fireForget China, the US Federal Reserve is the world’s biggest currency manipulator

As US President Barack Obama glided through China, a chorus erupted in New York and Washington: the problem with the global economy is China’s exchange-rate policy, and Obama’s No 1 job is to slay it. It’s sad that these people actually believe what they are saying: the same “logic” got the world into the current mess. In the feverish hallucination of salvation, they think that moving China’s currency policy would right all wrongs.

The US Federal Reserve is the biggest currency manipulator in the world. Not only does it keep the short-term interest rate at zero through its vast purchase programme for mortgage-backed securities, it also keeps credit spreads and bond yields artificially low. Its manipulation stops money, bond and credit markets from pricing either the Fed’s policy or the US economic plight. All the firepower is packed into the currency market, giving speculators a sure bet on a weaker dollar and everything else rising. Here comes the biggest carry trade ever: the Fed is promising no downside for shorting the dollar.

The US Treasury writes an annual report, judging if other countries are manipulating their exchange rates. It should look in the mirror. Even though the Fed is not directly intervening in the currency market per se, its manipulation is equivalent to pushing down the dollar by non-market means.

Goldman apologises for role in crisis

Francesco Guerrera, Justin Baer and Tom Braithwaite :

Goldman Sachs apologised for its role in the financial crisis on Tuesday and pledged $500m over five years – or about 2.3 per cent of its estimated bonus and salary pool for 2009 – to help 10,000 US small businesses recover from the recession.

The moves come as the bank tries to defuse a political and public backlash over its plans to share billions of dollars among top dealmakers after rebounding sharply from the turmoil and earning record profits in the first nine months of the year.

Lloyd Blankfein, Goldman’s chief executive, told a corporate conference in New York that the bank regretted taking part in the cheap credit boom that had fuelled the pre-crisis bubble. “We participated in things that were clearly wrong and have reason to regret,” said Mr Blankfein. “We apologise.”

Mr Blankfein also told the conference he wished he had not told the UK’s Sunday Times newspaper that Goldman did “God’s work” – a remark that was seized upon by the bank’s critics – and said it had been meant as a joke.

Mr Blankfein spoke hours before Goldman revealed plans to invest $500m over five years in business education, technical assistance and venture capital to help 10,000 small businesses across the US. The yearly amount of about $100m to be spent on the initiative – which will be overseen by a panel co-chaired by Warren Buffett, a Goldman investor – is equivalent to a good trading day at Goldman. In the third quarter, the bank had 36 days in which traders made more than $100m.

Mr Buffett told the Financial Times that the small business programme was not a response by the bank to recent criticism. “This is a big initiative,” he said. “This is not a one-day or one-year wonder. It’s a continuous programme.”

German Chancellor Angela Merkel Address to Joint Meeting of Congress

Twenty-years after the fall of the Berlin Wall, German Chancellor Angela Merkel addressed a joint meeting of Congress to discuss issues around the world including Afghanistan, climate change and int’l financial regulation.

‘Puzzlers’ reassemble shredded Stasi files, bit by bit

East German documents provide a crucial piece of history, supporters of the project say, but putting them back together could take hundreds of years. A computerized system would help, but it’s costly.

Reporting from Berlin and Zirndorf, Germany, – Martina Metzler peers at the piles of paper strips spread across four desks in her office. Seeing two jagged edges that match, her eyes light up and she tapes them together.

“Another join, another small success,” she says with a wry smile — even though at least two-thirds of the sheet is still missing.

Metzler, 45, is a “puzzler,” one of a team of eight government workers that has attempted for the last 14 years to manually restore documents hurriedly shredded by East Germany’s secret police, or Stasi, in the dying days of one of the Soviet bloc’s most repressive regimes.

Two decades after the heady days when crowds danced atop the Berlin Wall, Germany has reunited and many of its people have moved on. But historians say it is important to establish the truth of the Communist era, and the work of the puzzlers has unmasked prominent figures in the former East Germany as Stasi agents. In addition, about 100,000 people annually apply to see their own files.

A credibility problem for Goldman

It will be business as usual for Goldman Sachs this morning. The bank will annoy a lot of people.

Goldman, the institution that came through last year’s financial crisis best – arguably the only pure investment bank left standing – will say how much money it made in the third quarter (a lot) and how many billions it has stored for bonuses (about $5.5bn towards a likely 2009 bonus pool of $23bn).

For believers in Goldman’s ethical standards and way of doing business, these are difficult times. Although it avoided the mistakes that brought down Bear Stearns and Lehman Brothers, forced Merrill Lynch into Bank of America’s arms, and prodded Morgan Stanley further into lower-risk retail broking, Goldman has become a whipping boy.

There is outrage that, having taken government money to survive the crash, Goldman is in such rude health that it will hand out billions in bonuses. Matt Taibbi, a Rolling Stone writer, caught the mood memorably by describing Goldman as “a giant vampire squid wrapped around the face of humanity”.

Such is Goldman’s importance to Wall Street and regulation that I am devoting a pair of columns to it. Today, I will discuss the Goldman problem (different and less egregious to what Mr Taibbi believes, but still a problem). Next week, I will suggest what should be done about it by regulators and the bank itself.

Goldman executives were wounded by how seriously Mr Taibbi’s piece was taken despite their riposte that vampire squids are small creatures that present no danger to humanity. He accused it of profiting from bubbles such as the US internet and housing booms, and of repeatedly “selling investments they know are crap” to retail investors.

Loma Prieta Plus 20 Years

An earthquake that began beneath an obscure mountain in Santa Cruz County called Loma Prieta struck terror into Northern California 20 years ago this week on a beautiful fall afternoon, just as a World Series game was about to begin in San Francisco.

The quake lasted only 15 seconds, but it killed 67 people, smashed downtown Santa Cruz, wrecked San Francisco’s Marina district, broke the Bay Bridge – and changed much of the Bay Area.

Loma Prieta was one of those watershed events; in some ways, the disaster was a blessing in disguise. Out of it came a brand new San Francisco waterfront, the revival of a rundown neighborhood in Hayes Valley, major upgrades of classic buildings in downtown Oakland, and new laws on unreinforced old buildings. One of these years, a new eastern half of the Bay Bridge will open.

More notes and links on Loma Prieta, including my recollection(s) and that of Brian Zimdars.

How banks will get customers to cover a round of big losses

This, they toss off with the certainty of wine-fuelled genius, also explains the rise in the gold price.

Actually, I do not think that is how the bank risk paradox will play out.

There are going to be much larger write-offs and reserves taken at all the big banks, with the peak in reported bad news probably coming next year. However, the taxpayer will not be asked for more capital, and the Federal Reserve and Treasury will gradually dismantle the temporary support structures, just as they say.

How is this possible? Because the public will pay through usury, not taxation. There is a big difference, of course. Usury is less visible, and you cannot effectively vote against it.

Blood will flow, but it will do so not as a catastrophic bath for the banks, but as a gradual transfusion to them from their customers.

There will be headline risk for the banks’ management and public securities, which is why I think that their CDS protection is too cheap at the moment.

One source of headline risk is the spectre of Federal Government reform of the financial system. God knows there is a good case to be made for de-cartelising the industry, but that is not going to happen.

Bank spreads are at record levels. Their cost of funds is nearly 0, while they lend it out at 4.99% or (much) greater. Plus, the fees.

One Year Later, Little Has Changed

“By buying U.S. Treasuries and mortgages to increase the monetary base by $1 trillion, Fed Chairman Ben Bernanke didn’t put money directly into the stock market, but he didn’t have to. With nowhere else to go, except maybe commodities, inflows into the stock market have been on a tear. The dollars he cranked out didn’t go into the hard economy, but instead into tradable assets.”

— “The Bernanke Market,” Wall Street Journal, July 15, 2009

“In the last week alone, the European Central Bank allocated the record sum of $619 billion to 1,1,00 financial institutions – at a paltry 1 percent interest rate. And yet the money is not going where the central banks want it to go, namely into the pockets of businesses and consumers – at least not at reasonable interest rates.”

— “How German Banks are Cashing In on the Financial Crisis,” Der Spiegel, July 1, 2009

Two weeks ago, in meetings with their North Texas dealers, both Toyota and Honda voiced concern about how the economic recovery was going to hold up over the next few quarters. It wasn’t public news yet in the States, but Japanese executives already knew that their imports and exports had fallen sharply through the summer. And, while our business media were cheerleading because the Dow Jones was once again flirting with 10,000, in Japan their exports had just fallen 36 percent; metal shipments to the U.S. were down by more than 80 percent, automobile shipments by 50 percent. This was a problem here, too: In August America’s dealers seriously needed Japanese vehicles to restock their depleted inventories.

Toyota and Honda took different tacks for the fourth quarter. Toyota said it will spend $1 billion in advertising to move the retail market. Honda, always more cautious in difficult times, said it would spend nothing during the same period. Honda added that it will keep dealer inventories at a 30-day supply of unsold vehicles, half the inventory considered normal.