Legislative sausage supported by our elected officials only makes these “loopholes” worse. Here’s an example that both Russ Feingold and Herb Kohl supported – a 5.25% offshore earnings tax rate for major corporations. More here. Another example of special interest legislation.

Category: Taxes

The Subprime Collapse Didn’t Start Bothering the Bush Administration until Wall Street Bankers Started Whimpering

When individual borrowers began to suffer, Federal Reserve Chairman Ben Bernanke and Treasury Secretary Henry Paulson didn’t seem overly concerned. The market would clear out the problem through the foreclosure process. Loans would get written off; properties would change hands and be resold. When upstart subprime mortgage lenders ran into trouble, Bernanke and Paulson shrugged again. The market would clear out the problem through the bankruptcy process. Subprime companies like New Century Financial filed for Chapter 11, others liquidated or restructured, and loans made to the lenders were written down. Meanwhile, Paulson and Bernanke assured us that the subprime mess was contained.

But as the summer turned to fall, and the next several shoes dropped, their attitude changed. And that is because the next group of unfortunates to fall victim to subprime woes were massive banks. In recent years, banks in New York, London, and other financial capitals set up off-balance-sheet funding vehicles called SIVs, or conduits. The entities borrow money at low interest rates for short periods, say 30 to 90 days, and use the funds to buy longer-term debt that pays higher interest rates. To stay in business, the conduits must continually roll over the short-term debt. But as they searched for higher yields, some conduits stuffed themselves with subprime-mortgage-backed securities. And when lenders became alarmed at the declining value of those holdings, they were reluctant to roll over the debt. Banks thus faced a choice. They could either raise cash by dumping the already-depressed subprime junk onto the market, or bring the conduits onto their balance sheets and assure short-term lenders they’d get paid back.

Related: Credit Risk is Rising Again.

Morning Workout Zeitgeist, or “Let’s turn the Capitol into a Casino/Waterpark”

Props to the early morning workout group for this inspiration.

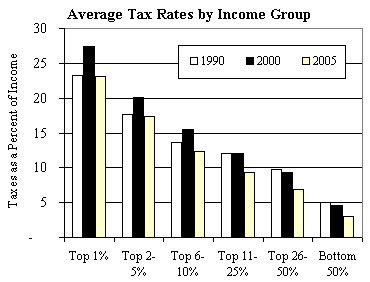

Average US Income Tax Rates

Greg Mankiw. It would be interesting to see a more detailed analysis of this.

Obama’s Earmarks

Senator Barack Obama (D-Ill.) requested federal funding for several projects as part of this year’s annual appropriations process. The projects, with the amounts designated by his constituents and several national organizations were released by the senator.

Random Tax Audits Return to the IRS

The Internal Revenue Service began this month selecting thousands of taxpayers for audits — even though the IRS has no reason to think they’ve underpaid their taxes. It’s part of the IRS’ National Research Program.

State of Wisconsin Federal Spending Profile

The following tables show aggregated prime contract dollar totals for the state of Wisconsin. Key data elements (agencies, companies, metropolitan areas) are ranked by their FY2006 – FY2007 YTD Totals. All aggregated data is copyrighted by Eagle Eye Publishers, Inc. Tables may not be reproduced without written permission from Eagle Eye.

Parsing Earmarks with Our Entrenched Political Class: David Obey….

John Solomon & Jeffrey Birnbaum:

Rep. Jeff Flake (R-Ariz.) confronted David R. Obey (D-Wis.), chairman of the House Appropriations Committee, on the House floor in March over this practice, noting that a spending bill then under debate contained $35 million for a risk-mitigation program at a federal space-exploration facility, even though the measure had been certified to contain no earmarks.

“We have passed some good rules with regard to earmark reform and transparency,” Flake said. “But we have found a way around them already.” Obey said that the provision was not an earmark under the rules. “An earmark is something that is requested by an individual member,” Obey said. “This item was not requested by any individual member; it was put in the bill by me.”

Two months later, Obey again rebuffed Flake when Flake pointed out that a supposedly earmark-free bill on the House floor contained an allocation of $8.7 million to ward off floods in New York. The provision was not called an earmark, Flake noted, but Rep. Nita M. Lowey (D-N.Y.) put out a news release applauding the provision and its potential benefit to her district.

Much more on earmarks, here.

Taxes & The Closing of Foreign Car Specialists

Beebe bought the business after working there a year and Lucey sold the building to the family of President Kennedy. Beebe said the Kennedys bought the building because they wanted a business reason to visit Wisconsin where the former president’s sister, Rosemary Kennedy, who was mentally retarded and lobotomized at age 23, spent decades at St. Coletta’s in Jefferson until her 2005 death at age 86.

Beebe bought the building from the Kennedy family in 1979 and recently paid off the mortgage

Hearing on Fair and Equitable Tax Policy for America’s Working Families

House Ways & Means Committee. Submit your statement to this useful event:

Chairman Rangel Announces Hearing on Fair and Equitable Tax Policy for America’s Working Families

House Ways and Means Committee Chairman Charles B. Rangel (D-NY) today announced the Committee on Ways and Means will hold a hearing on fairness and equity in the tax code. The hearing will focus on a number of tax fairness issues, including the tax treatment of investment fund managers and the impact of the alternative minimum tax on working families. It will also examine the reasons why investment funds are being organized offshore. The hearing will take place on Thursday, September 6, 2007, in 1100 Longworth House Office Building, beginning at 10:00 a.m.

In view of the limited time available to hear witnesses, oral testimony at this hearing will be from invited witnesses only. However, any individual or organization not scheduled for an oral appearance may submit a written statement for consideration by the Committee and for inclusion in the printed record of the hearing. A list of invited witnesses will follow.